A tax credit is a beneficial financial incentive to reduce your payable tax amount to the government. Not just deductions to lower taxable income, tax credits directly decrease the tax bill dollar-for-dollar. For example, if you owe $1,500 in taxes and qualify for a $500 tax credit, your tax liability is reduced to $1,000. Undoubtedly, tax credits are a great option for individuals and businesses seeking to save money on their tax liabilities.

The Federal Solar Investment Tax Credit (ITC) is a major financial incentive intended to promote the widespread use of solar energy in the United States. As of 2024, the ITC offers a 30% tax credit on solar installation costs, leading to great savings after investing in solar technology.

Let us further understand how the Federal Solar Investment Tax Credit works, solar cost, and eligibility in 2024. Also, how to claim the Federal Solar Tax Credit, what it covers, and its combination with other incentives. In addition, we will discuss claiming tax credits on rental property, adding more solar panels, and the consequences of selling the home.

What is the Federal Solar Tax Credit/ Investment Tax Credit (ITC)?

The Federal Solar Tax Credit or Investment Tax Credit (ITC) is a valuable financial incentive to encourage the adoption of more solar energy systems across the United States. The ITC is extremely important for making solar energy more affordable and accessible.

The current percentage of the ITC is 30% as of 2024 for both residential and commercial solar installations. The ITC applies to the total cost of the solar system, including equipment and installation. Being highly successful, ITC has contributed to the growth of solar energy in the U.S., and it has been a popular choice for people looking to reduce their energy bills and carbon footprint.

Extension of the ITC as Part of the Inflation Reduction Act, signed into law by President Joe Biden, this act maintains the 30% tax credit and also sets up a gradual decrease in the percentage over the coming years.

Here is a table that summarizes the ITC percentages over the years as set by the Inflation Reduction Act:

| YEAR | PERCENTAGE |

| 2022 | 30% |

| 2023 | 30% |

| 2024 | 30% |

| 2025 | 26% |

| 2026 | 22% |

| 2027 | 0% in Residential

10% in Commercial |

As we can see here, this table showcases the structured decline in the ITC percentage, which highlights the importance of investing in solar energy systems.

How the Federal Solar Investment Tax Credit Works?

The ITC makes it possible for taxpayers to exempt a considerable percentage of the solar system installation cost from their eligible federal taxes. As of 2024, this credit program helps cover 30% of the total installation costs, leading to huge savings.

For example, if your solar system costs around $20,000, the ITC would potentially cut your federal tax liability bill by $6,000. Hence, this reduction directly diminishes the owed tax amount and makes solar energy a lot more financially accessible for a wide range of people.

People often question whether there are income limits for claiming the ITC, but one of the most appealing aspects of the ITC is that there are no income limits for claiming the credit. While there are no income restrictions, your tax liability might limit the credit amount, where you can claim the ITC only up to the amount of federal taxes you owe.

You don’t have to worry about what will happen if the full ITC cannot be used in one single tax year because the ITC is 100% transferable and can be carried forward to the next tax years. And, if your tax liability is less than the qualifying ITC credit amount, you can add the unused portion of the credit to your taxes in subsequent years.

For example, let us assume that you are qualifying for an ITC of value $6,000, but you owe only $4,000 in taxes for that year. All that you can do is, use the required $4,000 to pay for your tax bill and carry forward the remaining $2,000 to the next year. By this, the taxpayers can be ensured of benefits from the ITC despite varying tax situations from year to year.

What’s the cost of Solar with the Federal Solar Tax Credit?

The average cost of solar panels can differ considerably depending on a few factors, including — location, system size, and installation requirements. As of 2024, the average price of solar panel installations ranges from $15,000 to $25,000 for a standard residential system. And, this price includes the panel cost, inverters, installation, and other required equipment.

Moreover, solar system’s cost per watt has been decreasing and making solar energy more accessible. On average, you can expect to pay around $2.40 to $3.30 per watt for a complete solar installation. However, solar panel price fluctuates based on market conditions, local incentives, and technology.

Factors affecting the total cost of solar panel systems are:

- Size of the System: Generally, large systems generate more electricity and are expensive, but help to save a lot on energy bills.

- Type of the Panel: The cost depends on the type of solar panels you choose, whether monocrystalline, polycrystalline, or thin film. Monocrystalline panels are more efficient and expensive than other types.

- Installation Costs: Local market rates and installation complexity impact the labor costs.

- Location: Geographical location can influence solar panel cost, sunlight received, system efficiency, and energy production.

- Incentives and Rebates: Local and state incentives can greatly reduce solar upfront installation costs.

Here are Examples of how the ITC reduces the overall cost of solar installations:

Example 1: If you are investing $20,000 in a solar panel system, you can claim a 30% tax credit i.e., $6,000 (30% of $20,000). Hence, it reduces the solar installation cost to $14,000 after applying tax credit.

Example 2: While you are investing in a larger system costing $30,000, you receive a tax credit of $9,000, reducing the overall cost to $21,000. Therefore, this reduction makes solar energy more financially appealing for homeowners.

What Does the Federal Solar Tax Credit Cover?

The federal solar tax credit covers a wide range of expenses involved with solar system installation, and here are the most essential components:

- Solar Panels: The complete cost of solar panels is covered under the ITC, including — panels themselves and the necessary equipment for its operation.

- Inverters: To convert the solar panel-generated direct current (DC) into alternating current (AC) electricity, ITC covers the cost of inverters.

- Mounting Equipment: Most essential mounting system installations are covered in ITC, for secure solar setup.

- Energy Storage Systems: To store solar panel-generated energy, ITC covers the investment of battery storage systems to store excess energy.

- Installation Costs: You can claim credit for professional services for setting up your solar panels, as the ITC covers installation costs too.

- Permitting Fees: One of the most useful coverages in ITC is that you don’t have to bear the fees for obtaining the necessary permits regarding your solar installation.

Inclusion of Labor Costs and Sales Taxes in the ITC Coverage:

- Labor costs are included in the ITC coverage, allowing you to claim the expenses of hiring professionals for your solar system installation. And, this inclusion is crucial because installation cost holds up to a greater portion of the total project cost.

- Sales taxes on solar equipment purchases are eligible for the ITC, allowing you to calculate and claim your tax credit if you have paid sales tax on solar panels, inverters, or other equipment.

Federal Solar Tax Credit Eligibility in 2024

To be able to determine easily whether solar owners qualify for the ITC in 2024, here is the checklist to follow:

Ownership of the Solar System: To qualify for the ITC, you must own the solar system and if you are leasing or opting for a PPA (Power Purchase Agreement), you will not be eligible for the tax credit.

Installation Date: The solar system must be installed by the end of the year, to claim the tax credit of that financial year and if it crosses 31st December, you will not be able to claim the credit.

Type of Solar Technology: The ITC is favorable to different solar technologies, including photovoltaic systems and solar water heating systems.

Primary Residence or Business Location: You must install the solar system on your property as your primary residence or business location. Installation on a rental property might still qualify, but specific conditions apply.

Cost of Installation: The ITC covers 30% of the total installation cost, including equipment, labor, and necessary permits. So you must ensure to keep records of all expenses related to your solar installation.

Tax Liability: To benefit from the ITC, you must have a federal tax liability equal to or greater than the claiming credit amount. If your tax liability is lower than the credit, it can be carried forward.

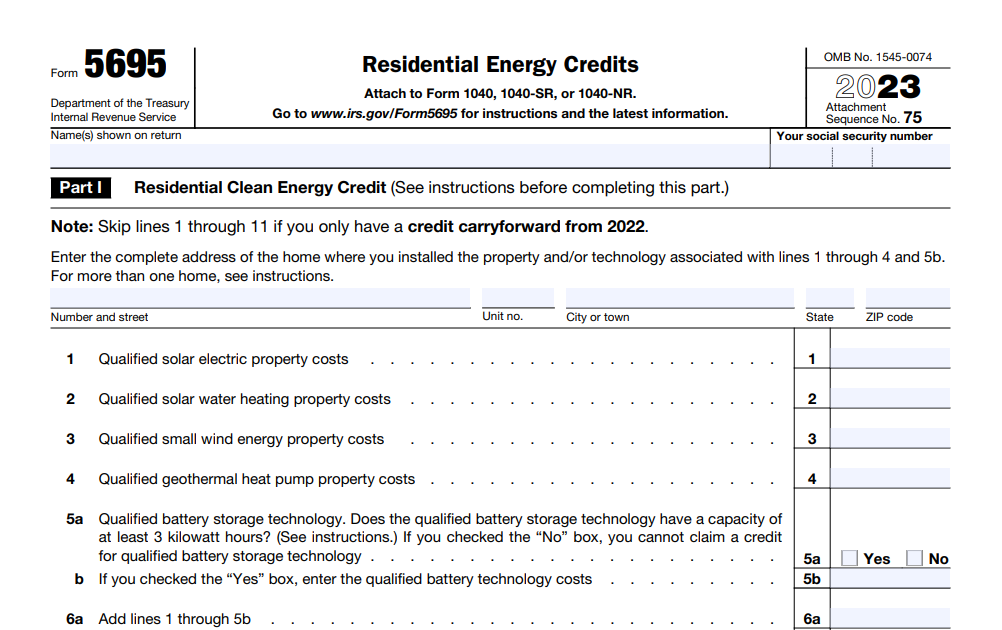

Filing Requirements: You will need to complete IRS Form 5695 while filing your taxes by providing details of your solar installation.

State and Local Incentives: For solar installations, ITC is a federal program where many states offer additional incentives, rebates, or tax credits.

By following this checklist, solar owners can determine their federal solar tax credit eligibility in 2024. Hence, this credit helps to lower the upfront costs of solar installation and promotes using renewable energy.

How to Claim the Federal Solar Tax Credit?

To claim the investment tax credit, you must fill out IRS Form 5695, specifically intended for eligible taxpayers. While filling out Form 5695, you will report the total cost of your solar installation, helping you to calculate and determine the tax credit amount based on the percentage of the installation costs.

While claiming the ITC, it is extremely important to have the proper supporting documentation to claim. Here is what you typically need:

- Proof of Purchase: You must keep all solar installation-related receipts, and invoices including — solar panel cost, inverters, and additional equipment for the system’s operation.

- Installation Agreement: If you hire a contractor, you must have an installation copy of the agreement that covers the labor work and the total cost.

- Photographs of the Installation: Usually it is not required to have photographs, but it will additionally support your claim, especially if there are any queries about the installation.

- Form 5695: This form must be filled and submitted with your tax return to claim the credit.

You can claim the Investment Tax Credit in the same tax year when the solar system is installed and started operating. It is crucial to note that the ITC is a non-refundable credit, which means it can reduce your tax liability to zero, but it won’t ultimately result in a refund.

Also, if your tax liability is lower than the credit amount, the unused portion can be carried forward to the following tax year.

Can You Combine Federal Solar Tax Credit With Other Incentives?

Yes, you can combine several incentives with the ITC to get the most savings on solar energy investments.

1. State-Specific Solar Incentives

There are a few states that offer their own solar incentives, to reduce the overall cost of solar panel installations. States like California, Florida, and Texas offer many kinds of tax credits, rebates, and net metering programs.

- California: Offers a wide range of incentives, including the “California Solar Initiative”, providing cash rebates for solar installations.

- Florida: You can benefit from “Property and Sales tax exemptions” on solar equipment.

- Texas: Offers a “Franchise tax exemption” for solar systems, and makes it affordable for businesses to invest in solar.

2. Local Utility Incentives

Most of the local utility companies are offering additional incentives for adopting solar energy, including — solar panel rebates, performance-based incentives, or grants. You can combine these local utility incentives with the ITC, and improve your ROI (Return on Investment).

3. Federal Tax Credits for Energy Efficiency

Along with the ITC, you can also qualify for other federal tax credits which focus on energy efficiency improvements. Also, it allows tax credits on many renewable energy investments like — solar, wind, and geothermal systems.

You can maximize your savings by combining the ITC with state-specific incentives, local utility rebates, and federal energy efficiency credits.

For example, if you are a resident of California who has installed a solar system costing $20,000, you will receive a 30% tax credit from the ITC (30% of $20,000 is equal to $6,000). Additionally, if you are qualifying for a state rebate of $2,000 and a local utility incentive of $1,000, your total savings would reach up to $9,000.

What Is The Future of the ITC?

The IRA (Inflation Reduction Act) was brought to law in August 2022, and it focuses on putting an end to price inflation.

The ITC (Investment Tax Credit) has been a valuable contributing factor in boosting solar renewable energy investments in the United States. In the future, the Inflation Reduction Act will play a very important role in shaping the overall structure of the ITC program.

Here are the impacts of the Inflation Reduction Act on key modifications and extensions to ITC programs:

- Extended Credit Duration: IRA has extended the ITC at a 30% rate for projects constructed before 2033. This extension provides developers and investors with a longer timeframe to take full advantage of tax benefits.

- Increased Accessibility: The IRA has introduced changes, making the ITC more accessible to a wide range of projects and encouraging investment in low-income areas, and more individuals will start to invest in solar systems.

- Bonus Credits: This framework allows bonus credits to essentially make use of locally sourced materials, resources, and labor.

- Integration with Other Incentives: The IRA allows combining ITC with other federal and state incentives to further enhance overall financial stability. This integration brings in more investors and helps speed up the process of switching to clean energy.

Is the Solar Tax Credit Refundable?

The ITC is not refundable, especially if the credit exceeds the owed tax amounts. As an alternative, the ITC permits taxpayers to deduct a certain percentage of solar installation cost from federal taxes and as of 2024, it is set at 30% of the total installation costs).

Due to the non-refundable characteristics of the ITC, the taxpayer will not receive the difference amount as a cash refund even if the tax liability is less than the credit amount.

Taxpayers might not fully benefit from the ITC immediately, with a lower tax liability in the year of installation. However, it is still beneficial as the unused part of the credit can be carried forward to future tax years. And, if you were not able to utilize the complete credit in the same year of solar installation, you must make use of the remaining credit to your following year’s taxes until it is fully used.

Can the Federal Solar Tax Credit be claimed On My Rental Property?

Yes, you can claim the Federal Solar Tax Credit on your rental property, but you will face certain limitations.

Limitations in claiming the federal solar tax credit on rental property:

- Primary Residence Requirement: If you own a property, it must be used solely for residential and not commercial purposes.

- Personal Use: If you are using the rental property for a personal reason, you might have a reduced tax credit amount to claim. The IRS makes it clear that only the portion used for rental purposes will be applicable for the credit.

- Installation Costs: The costs that are eligible for the tax credit include — Solar panel purchase, installation, inverters, and other required equipment. Instead of purchase and ownership, if you leased the solar system, you won’t be eligible for the tax credit.

- Claiming the Credit: You must fill and submit the IRS Form 5695 along with your tax return to claim the Federal Solar Tax Credit.

- Future Developments: The IRS frequently modifies its guidelines, which might impact eligibility or the percentage of the credit available.

Can I claim the ITC for adding solar panels to an existing system?

Yes, of course, you can claim the ITC (Investment Tax Credit) for adding solar panels to an existing solar system. And, you are allowed to claim up to 30% of the total installation costs, including new solar panels and related equipment for upgrade.

Factors affecting the ITC claim while expanding solar system:

- Date of Installation: The ITC is applicable to claim credit only if the solar systems are installed and operational before the end of the tax year.

- Total Cost of the System: Calculating ITC is based on the total cost of the solar installation, including labor and equipment. If you are adding more panels, make sure to correctly document all those costs and include them in your claim.

- Eligibility of Components: Sometimes the installation service costs might not be eligible due to certain rules. So you must re-verify which parts of your installation can be calculated for the ITC.

- Homeowner vs. Business Use: The ITC rules can differ, where Homeowners can claim the ITC for personal use, while businesses might have some extra points to be considered.

- Previous ITC Claims: It is recommended to consult a tax professional if you already claimed the ITC for your existing system because you must consider how the new panel addition impacts your overall tax situation.

- Documentation: It is essential to keep proper documentation of all receipts, contracts, and installation records to solidify your ITC claim.

What happens to the ITC if I sell my home?

When homeowners decide to sell their property, the ITC (Input Tax Credit) impacts their financial situation in a few ways.

Here is how ITC impacts on homeowners selling their property:

Claiming ITC on Purchase: Those homeowners who purchased their property and claimed ITC on either construction or renovation costs might have to make adjustments to their ITC claims while selling the property.

- If the property is sold before 5 years, homeowners will have to pay back a certain amount of the ITC claimed.

- Homeowners will have to repay the previously claimed tax credit to the tax authorities, which impacts the overall profit from the property sale amount.

Sale of Residential Property: If the property is a residential type, the ITC benefits tend to vary because usually residential properties are exempted from GST (Goods and Services Tax) while selling. So, homeowners will not be able to claim ITC on their property sale.

- In case the property was used for commercial purposes or rent, then different rules apply, which might allow ITC claims on property sales.

Capital Gains Tax Considerations: While the homeowner is selling their property, it increases the capital gains tax associated with it. If the homeowner already claimed ITC on the property, it will affect the calculation of capital gains and reduce the overall property cost.

Documentation and Compliance: Homeowners must keep the proper documentation and transaction details related to all ITC claims. They must have all the associated invoices, receipts, and any written documentation with tax authorities.

Consulting a Tax Professional: There are certain complexities associated with ITC and property sales. So it is recommended that homeowners consult a tax professional who will guide them based on their personal circumstances.

Ray is an avid reader and writer with over 25 years of experience serving various domestic and multinational private and public energy companies in the USA.